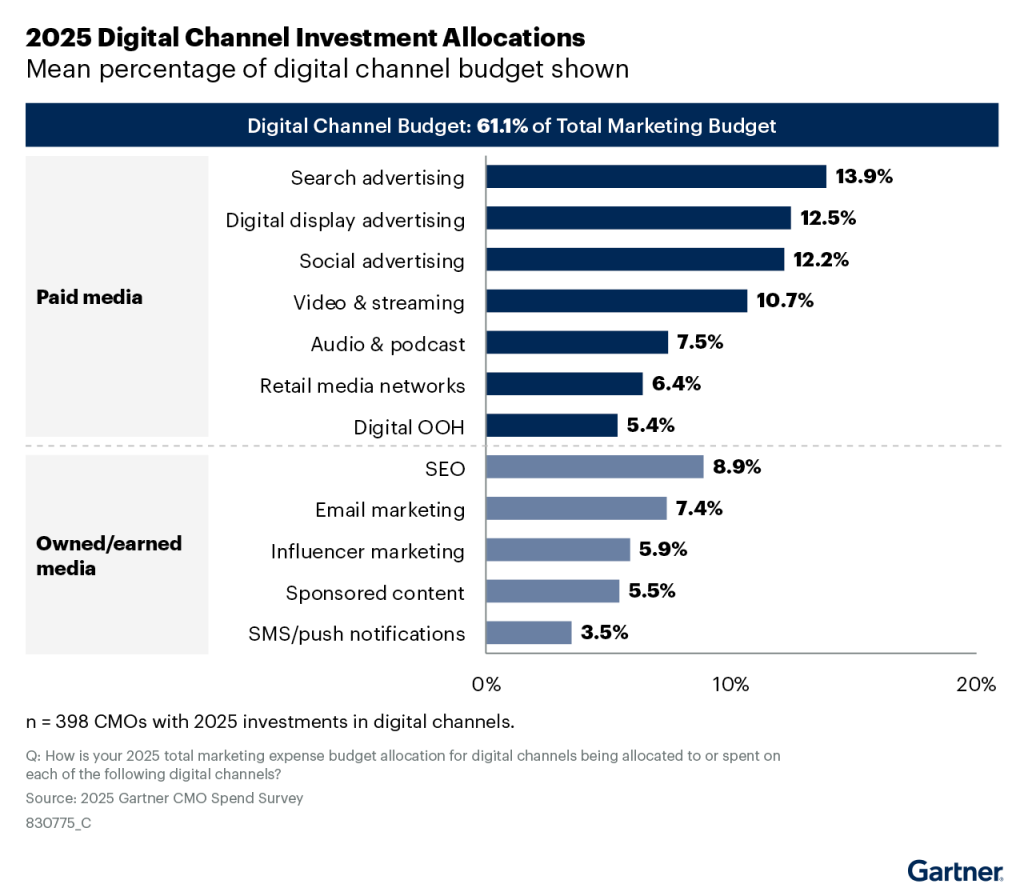

Digital channels now account for more than 60% of overall marketing spend, according to new research presented by Gartner at its Marketing Symposium/Xpo this week in Denver. The 2025 CMO Spend Survey, based on responses from over 400 marketing leaders in North America and Europe, found that 61.1% of budgets are now allocated to digital, highlighting a structural shift in how brands approach audience engagement.

Paid channels dominate the digital category, representing 69% of total digital investment. Paid search remains the top allocation, increasing marginally to 13.9% of the total marketing budget. Digital display ads have now overtaken social advertising for the second spot, with a 17% year-over-year increase bringing their share to 12.5%. Social media spend held steady at 12.2%.

The data reflects a broader rebalancing of marketing strategies, as CMOs contend with new technologies and persistent uncertainty in digital ecosystems.

Ewan McIntyre, Gartner’s Chief of Research for its Marketing Practice, said the trend “reflects a strategic pivot as CMOs recognize the need to adapt to rapidly changing consumer behaviors and technological advancements.”

The timing of this shift is notable. With Google’s decision to delay third-party cookie deprecation again, and ongoing concerns about TikTok’s regulatory future in major markets, marketers are recalibrating plans amid unstable platform policies and privacy expectations. Simultaneously, the growing influence of generative AI tools is transforming content production and performance optimization—adding complexity to budget decisions.

Email marketing was one of the few owned or earned channels to show resilience, inching up slightly to account for 7.4% of digital spend. In contrast, other non-paid channels saw a collective 9% year-over-year decline, underscoring how much pressure these lower-cost channels face in proving their value in a performance-driven environment.

Retail media networks, which provide ad placements directly on e-commerce and retailer platforms, have emerged as a significant player. According to Gartner’s impact rankings, these networks now outperform video and streaming, which have slipped due to targeting difficulties and platform saturation. Linear TV, while still receiving substantial budget from certain industries, continues to rank lower in terms of perceived impact—though it remains a mainstay for building brand awareness.

McIntyre noted that the emphasis is shifting to measurable outcomes. “Strategic implications of multichannel plans become paramount,” he said, pointing to budget pressures and channel volatility as persistent challenges.

For marketers, these shifts point to a critical need to reassess channel portfolios, scrutinize ROI across digital formats, and respond flexibly to new tools and regulations. The rise in digital spend may suggest increased confidence in data-driven tactics, but it also brings scrutiny over effectiveness, especially as expectations for accountability rise at the C-suite level.

The Gartner Marketing Symposium/Xpo continues through June 4, with sessions focused on marketing analytics, CX strategy, and innovation in digital campaign planning. For marketing professionals watching these trends, the numbers suggest a continued move toward paid digital strategies—with performance now the dominant metric shaping the conversation.